Appraisal Time is Upon Us

2018 is a Reappraisal year for Hardeman County. It is state mandated that all counties in the state undergo a reappraisal either every 4, 5, or 6 years. In Hardeman County we are on a five year reappraisal cycle, so the last time we went through a reappraisal was in 2013.

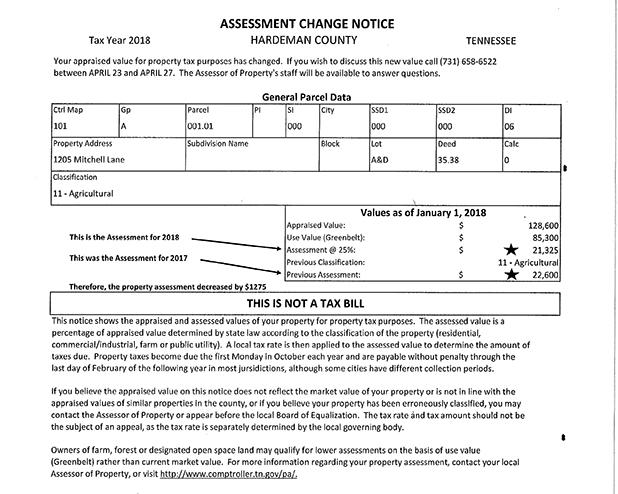

The purpose of the state mandated reappraisal is to bring all property values to current market value. In the next few days, the Hardeman County Assessor of Property office will be mailing Assessment Change Notices to every property owner in the county who owned property as of January 1 2018. THIS IS NOT A BILL!! It is a notification that your assessment value has changed due to current sales data, as required by law. The notice will have the appraised value of the property, the use value (Greenbelt value) if applicable, the current assessment, and the previous assessment. If your assessment is higher than your previous assessment, that means your property value went up. If your assessment is lower than your previous assessment then that means your property value went down. It is my goal to inform every citizen of Hardeman County about the process of Reappraisal as we continue to provide the most transparent administration of the local assessment process possible.

One very important thing to point out is that you will not see a tax amount due on this notice. That is because the Assessor of Property office does not set the tax rate. The tax rate is set by the County Commission and the City Councils in your respective municipalities. The Assessor of Property does not set the budget, nor does the Assessor of Property collect the taxes. We value the property based on current sales to restore equality and treat everyone fairly.

Frequently Asked Questions:

Q: What is a Reappraisal and why is it conducted?

A: Reappraisal is conducted in Hardeman County pursuant to Tennessee State Law, TCA 67-5-1601, which requires each county to periodically update property values to reflect current market value. This process eliminates inequities that happen over time by changes in the real estate market. Reappraisal works to ensure fairness to all property owners.

Q: How is Market Value Determined?

A: Value is based on calculations of collected sales data from all real estate transactions in Hardeman County taking into consideration other factors affecting real estate value such as age, quality, condition, and location of the property. We also use the cost approach and income approach to value commercial properties. All of which are standard appraisal methods. The best indicator of current market value is qualified (willing buyer and willing seller) prior year sales to determine reappraisal values.

Please remember this is not changing the property value from last year. This is changing the property value from our last county wide state mandated reappraisal which was in 2013. We will be having informal hearings on the new values in our office the week of April 23 -27. If you have any questions or concerns, please give us a call or come by our office and we will be happy to assist you.